Nest Wealth

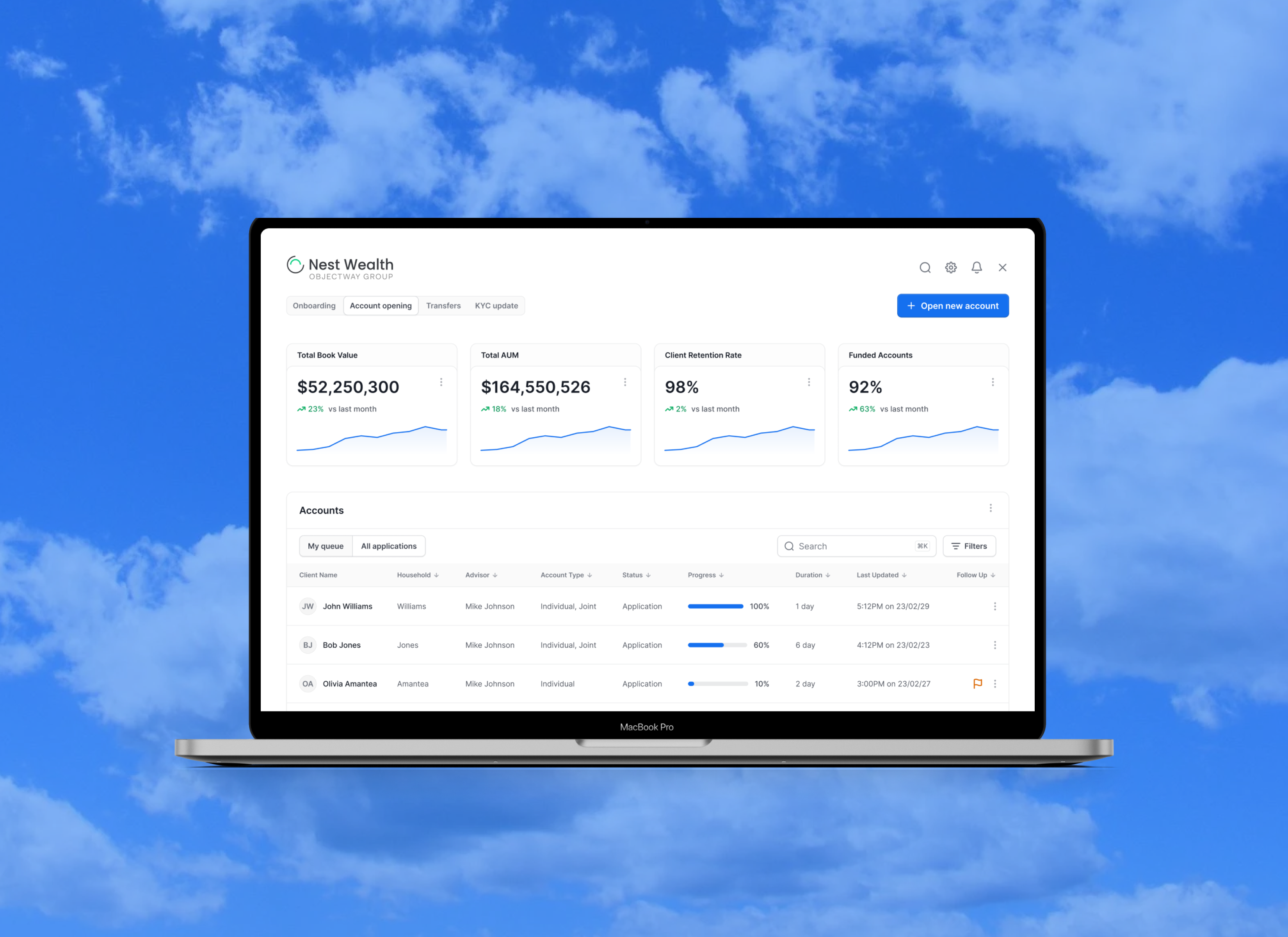

Enhancing investor onboarding for Nest Wealth Pro

Role

Product designer

Platform

Web

Year

2023

Duration

3 Months

Problem statement

Highlights in our research showed that financial advisors often work with families, not just individuals. The existing onboarding process requires advisors to onboard each client separately, even if they belong to the same household. This created inefficiencies and made financial management more complicated for:

- Families wanting to consolidate multiple accounts under one advisory relationship

- Advisors who needed a streamlined workflow to view and manage all household assets collectively

- Firms that sought better compliance tracking and reporting for households rather than individual accounts

By introducing house-holding into the onboarding process, our goal was to:

- Improve the efficiency of the client onboarding experience.

- Enhance transparency by allowing a holistic financial view.

- Reduce the administrative burden on advisors.

- Increase client satisfaction through simplified financial management.

Discovery

To validate the need for house-holding, I conducted extensive research through multiple methods:

User Interviews

I interviewed 15 financial advisors and 10 investor clients to understand their biggest pain points and gather insights on how they manage family wealth

- Advisors found that onboarding each household member separately created significant inefficiencies, often requiring them to duplicate data entry.

- Clients expressed frustration with managing multiple individual accounts, preferring a consolidated view of household investments.

- Advisors highlighted that compliance tracking would be easier with a system that groups family members together.

Competitive Analysis

I examined similar financial advisory platforms to identify industry best practices and gaps in existing solutions:

- Many competitors also required individual onboarding, leaving an opportunity for Nest Wealth Pro to differentiate itself.

- A few platforms allowed limited household management but lacked customizable permissions and streamlined document handling.

- The competitive landscape reinforced the need for a comprehensive house-holding approach.

Usability Testing

To ensure the proposed house-holding feature was intuitive and effective, I created a prototype and conducted usability tests with 10 financial advisors:

- Advisors were able to onboard family members 35% faster than the current system.

- The unified household dashboard was well-received, with 90% of testers finding it easier to use.

- Compliance tracking improvements were noted as a key advantage, reducing manual effort.

Solution

Based on research highlights, I designed and developed a household onboarding system with the following key features:

Household Grouping

Advisors can create a family unit and assign roles (e.g., primary account holder, secondary holder, dependents).

Unified Documentation:

Streamlined collection of required KYC and compliance documents for all household members.

Portfolio Aggregation:

Advisors can view all investments under a single household dashboard.

Customizable Permissions:

Different access levels for household members to view or manage assets.

Seamless Data Entry:

Pre-populated information fields for dependents to reduce redundant data entry.